irs unemployment benefits tax refund

2872021 Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. The IRS will continue to.

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com

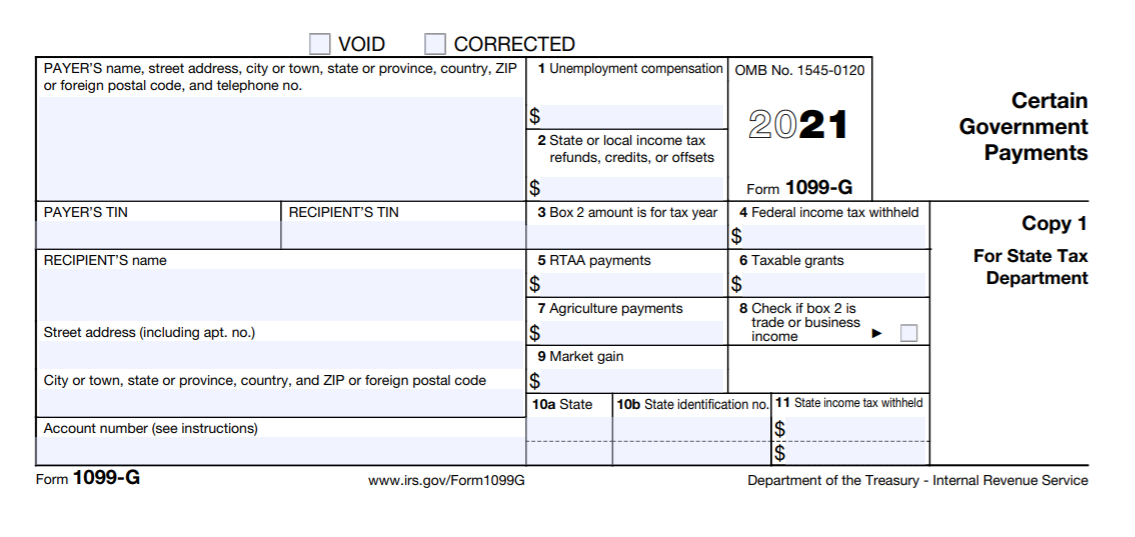

You should receive Form 1099-G Certain Government Payments showing the amount of unemployment compensation paid to you.

. What is the IRS Treas 310 tax refund. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. The IRS has been unresponsive.

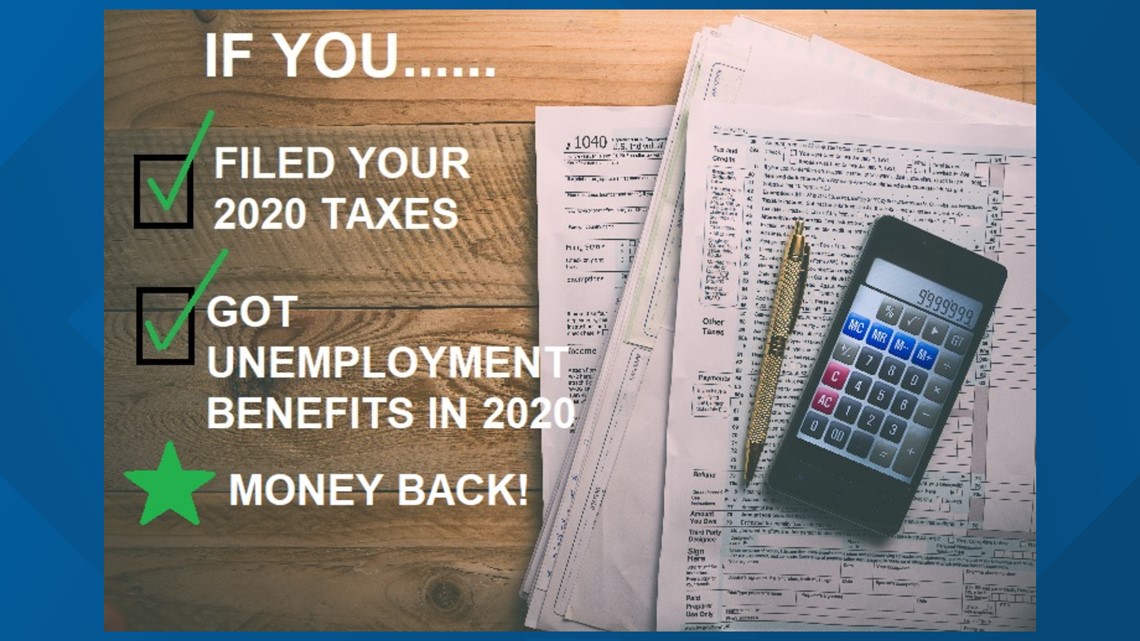

If it didnt changed your current income for example you are within the 10 tax bracket then chances are you wont. While the majority of people who are owed a refund for the 10200 unemployment compensation adjustment will have their return automatically adjusted for the adjustment the. If you filed your taxes before the new law went into effect dont worry.

Not everyone will get it. The IRS estimated on Friday that up to 13. The legislation excludes only 2020 unemployment benefits from taxes.

The Internal Revenue Service IRS will issue an additional 15 million tax refunds averaging more than 1600 this week to filers who paid too much in taxes for their 2020. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. This threshold applies to all filing statuses and it doesnt double to 300000 if you were married and file a joint return.

Unemployment benefits caused a great deal of confusion this tax season. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the. Y_kenman 1 yr.

The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. The unemployment tax refund is only for those filing individually.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. Any unemployment compensation in excess of 10200. Taxpayers should not have been.

The agency reported that the average payment for a tax refund is 1265 and most recipients will not have to complete any action to get the payment. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. An Economic Impact Payment known as EIP or stimulus payment this will show as IRS TREAS 310 and have a code of TAXEIP3.

Also those that got their refund. On May 14 the IRS announced that tax refunds on 2020 unemployment benefits would begin to be deposited into taxpayer bank accounts within. Fortunately the unemployment tax nightmare that left many with reduced refunds or an unexpected tax bill.

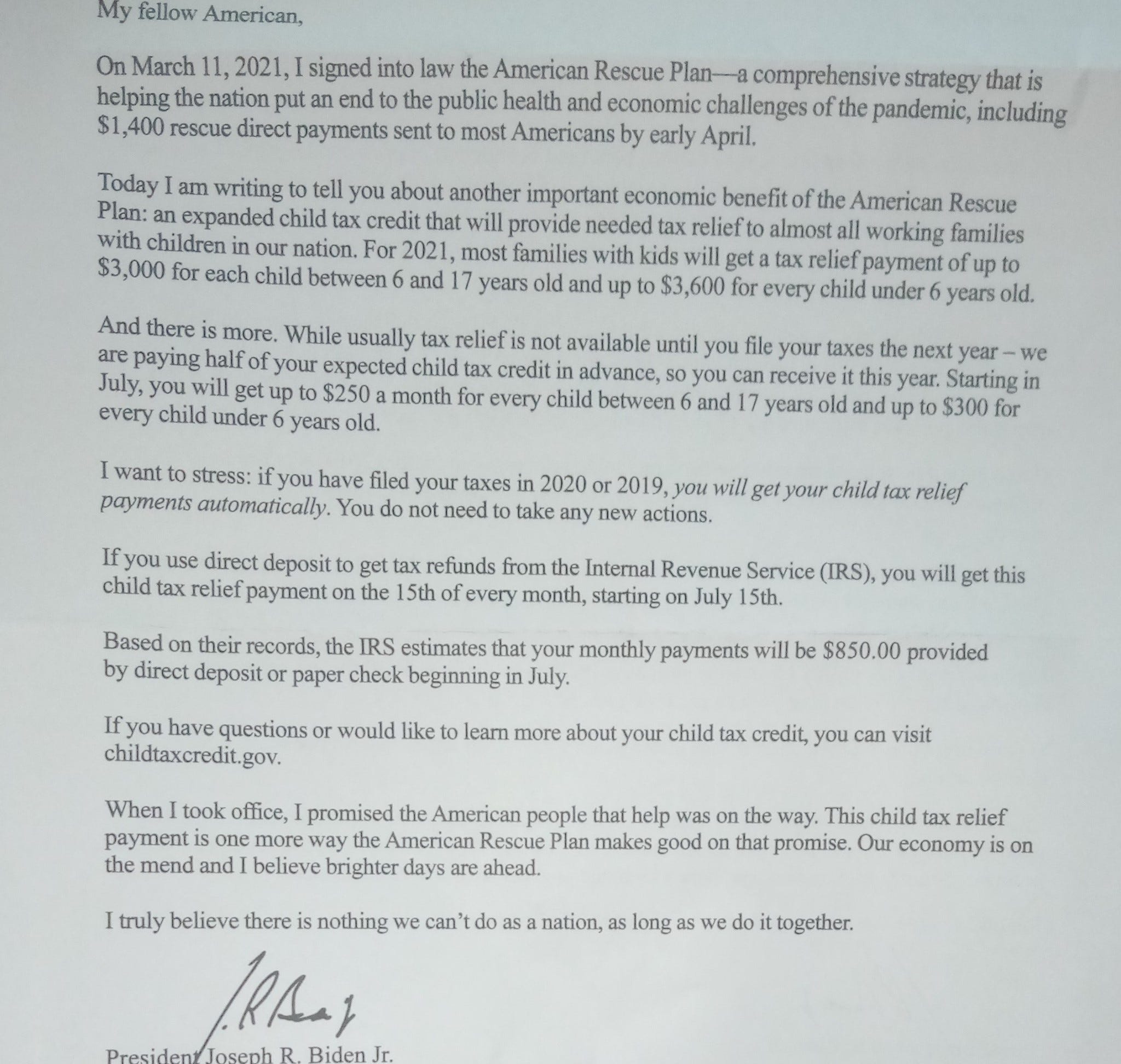

The IRS will continue reviewing and adjusting tax returns in this. The IRS announced earlier this month that the agency had begun the process of adjusting tax. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020.

Any overpayment will be refunded by the IRS. This refund may also be applied to other taxes owed. Because the change occurred after some people filed their taxes the IRS will take steps in the spring and.

IR-2021-71 March 31 2021. When Will The Irs Send Refunds For The Unemployment Compensation Tax Break. The law waived taxes on up to 10200 in 2020 unemployment insurance benefits for individuals who earn less than 150000 a year.

Report Unemployment Compensation. WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and. A quick update on irs.

The IRS will continue reviewing and adjusting tax returns in this.

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Here S When You May See A Tax Refund On Unemployment Benefits Up To 10 200 Pennlive Com

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

Irs Issues More Tax Refunds Relating To Jobless Benefits

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

Irs Sending You More Money Unemployment Refunds Coming Kare11 Com

Irs Says Unemployment Refunds Will Start Being Sent In May How To Get Yours Mlive Com

Here S How To Get Your Unemployment Tax Refund Irs Says Payments Coming In May Silive Com

Tax Refunds Averaging 1 600 Are On The Way Here S Who Gets The Money Wkrc

2021 Unemployment Benefits Taxable On Federal Returns Cbs8 Com

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Sends Out 4 6 Million Refunds To Taxpayers For Overpayments Wfmynews2 Com

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

The Irs Will Refund Those Who Overpaid Taxes On Unemployment Benefits

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Irs Sends 2 8 Million Additional Refunds To Taxpayers For Unemployment